services for home owners

professional management

we take care of your property

We take care of your property as if it is our own. We will relieve you from the responsibilities that come along with holiday renting. We are a trustworthy partner. So you will have peace of mind and more free time for all the things that actually matter in life.

Strategy

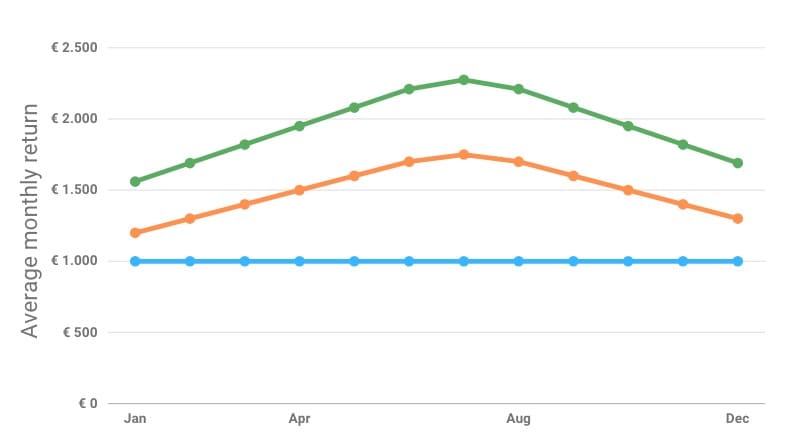

We reach your goals

We will not only take care of your property, we will also increase the revenue and select the right guests.

We are experts at revenue management and we outperform the competition in the market year in year out.

We publish your property on 25+ platforms and are able to screen guests according to your wishes. Popular criteria are for example: families only, couples 30+, no pets, no groups.

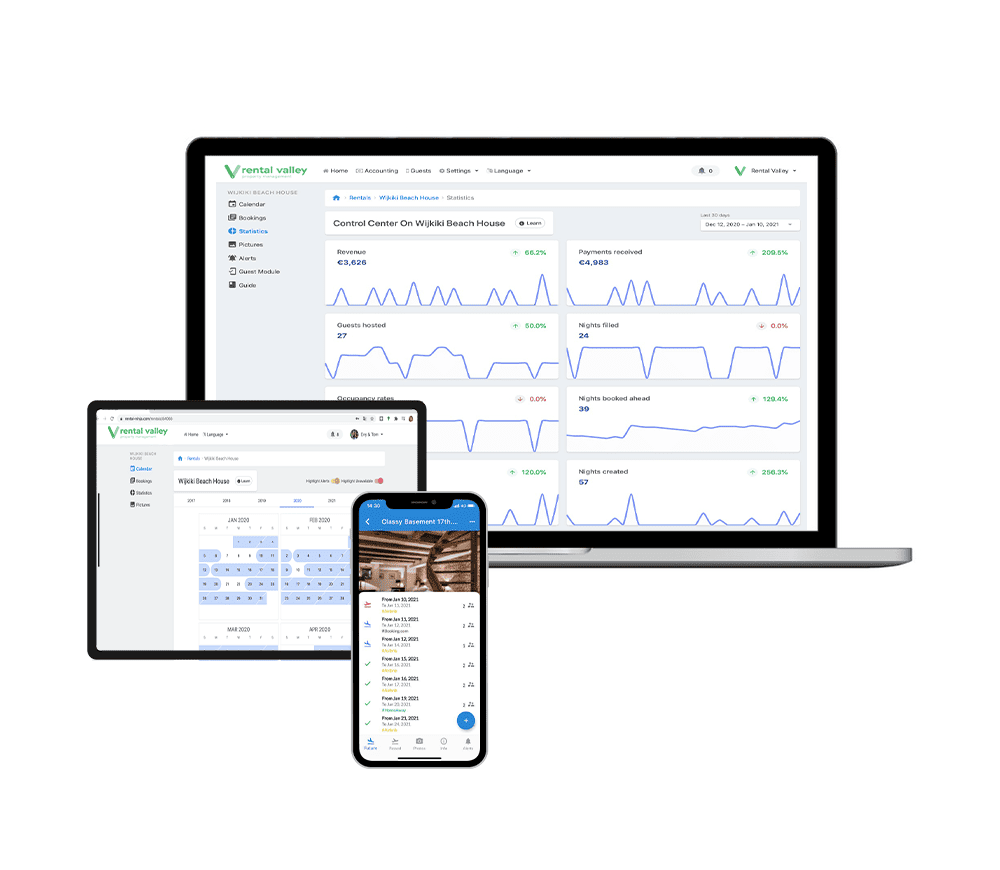

owner dashboard

We communicate with you

Your personal dashboard informs you about your upcoming bookings, monthly and yearly revenues and overall performance. We also have a mobile app so you can stay up to date on the road. We offer complete transparency, allowing you to stay well informed 24/7.

Our accessible dashboard allows you to block and unblock dates as you please! Alternatively, you can get in touch with our support team and inform us about the dates you want to block in your calendar.

Property management

Our Services

Listings

We create stand-out advertisements across 25+ platforms, with expert copywriting and professional photography.

Guests

You decide who we rent your home to. We set up a profile with your demands and screen every potential guest. No match? No booking.

Cleaning

Our well-trained housekeepers take care of every change-over and leave it perfectly clean and ready for the next guests.

Maintenance

For small jobs we have reliable handymen. They are ready to perform small maintenance and repairs in case needed.

Check in / out

We'll completely organise all activities to do with check-in and check-out, ensuring the whole proces seamless

Professional Photography

A single picture tells more than a thousand words. That’s why we’ll send over one of our professional photographers to capture your home from its best side.

Linen & Towels

We'll supply the linen & towels! Our professional cleaning team will ensure everything is perfect for your guests arrival.

Re-stocking Essentials

Your accommodation will always be re-stocked with essentials for guests like toilet rolls, dishwasher liquid, soap etc.

24/7 support team

Our 24/7 multilingual support team will look after potential guest questions, inquiries and bookings from anywhere in the world, at any time.

Investment Advice

We give you a free appraisal for your property on the rental market. Informed investment starts right from the beginning.

We Have Great Answers

Ask Us Anything

When a guest books a stay via one of the platforms they’ll pay a nightly fee in addition to a set cleaning fee. The entire amount is transferred to us.

Rental Valley will then charge you a commission on that total. In case you are on the full management plan we will also settle you for the cost of the cleaning fee too (in order to pass on to our suppliers and housekeepers).

Whilst you’re technically charged for each clean, it’s important to bear in mind that your guest has paid for this.

You’ll be paid the owner payout every 15th of the month after your guest checks-out.

Our Support Team manages daily hundreds of bookings. They’re trained to spot red flags, and will always prioritise security over occupancy. We’d never take a risk with your property, even if that means saying no to some bookings. All guests must have a verified profile and be able to provide us with details about their trip.

We use the following booking platforms for our listings:

- Airbnb

- Booking.com

- book.rentalvalley.com

- TripAdvisor

- Expedia

- VRBO

- HomeAway

- Homelidays.com

- Abritel.fr

- FeWo-direkt.de

- Yahoo

- Agoda

- Trivago

- And many more…

If you rather keep your property off a certain platform, let us know

We have strong processes to vet guests and ensure we control who stays at your place, but we do ask you to not keep any valuable in the property when it is available in the short-let market.

In the unlikely event, guests damage or steal from your property, our team of issue resolution specialists will do their best to recover the loss it would incur for you liaising with the platform and guests. we work with security deposits via a secure credit/debit card imprint. If you rental property is damaged, we will process the payment of your security deposit and handle any disputes that may arise. If the booking was made through Airbnb, you are eligible for a $1,000,000 Host Guarantee coverage at no additional cost.

We have a dedicated maintenance team that works with several contractors. Pricing varies depending on the nature of the task. We can arrange smaller jobs without contacting you, but it’s important to discuss a maximum spend limit with your support team. Any task quoted over the limit will require your approval.

We’ll follow up with the guest to leave a review, answer any questions and provide any further feedback.